View by Topic

Recent Articles

-

Congress Blocks California’s Gasoline Car BanSaturday, May 31st, 2025

-

EPA Will Keep Current Limits for “Forever Chemicals” in Drinking WaterSaturday, May 24th, 2025

-

Court Indefinitely Pauses SEC Climate Rule LitigationSaturday, May 17th, 2025

-

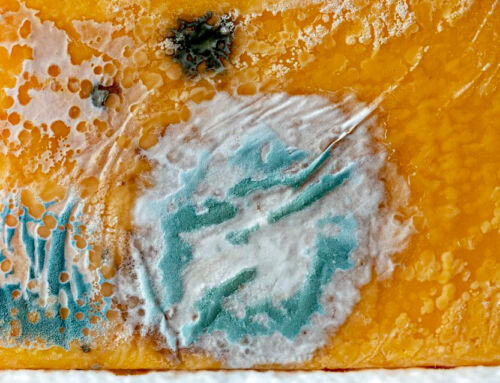

Maryland is About to Regulate Mold But is the Cart Before the HorseSaturday, May 10th, 2025

View by Month/Year

“Green Building Law Update” Headlines

Recent Articles & News from

Stuart Kaplow’s blog

at GreenBuildingLawUpdate.com

- Congress Blocks California’s Gasoline Car Ban: A Legal and Policy Analysis June 1, 2025

- EPA Will Keep Current Limits for “Forever Chemicals” in Drinking Water May 25, 2025

- Court Indefinitely Pauses SEC Climate Rule Litigation May 18, 2025

- Maryland is About to Regulate Mold: But is the Cart Before the Horse? May 11, 2025

Subscribe to the Green Building Law Update!

Stuart Kaplow brings his expertise and extensive experience to the table with his unique digital publication, "Green Building Law Update". Subscribers receive regular updates to keep them informed about important issues surrounding Environmental Law, Green Building & Real Estate Law, as well as the emerging demand for Environmental Social Governance (ESG).

Get fresh content through the lense of Stuart Kaplow's cutting-edge expertise, innovative commentary and insider perspective. Don't miss another issue! Subscribe below.

SEC Extends Comment Period for Proposed Rules on ESG Related Disclosures

On October 7, 2022, the U.S. Securities and Exchange Commission reopened the public comment periods, for 14 days from the day the notice is published in the Federal Register, for 11 of its rulemaking releases, some of them viewed as controversial including the rule discussed in this blog post, due to a technical glitch that led to a number of comment letters being lost.

The Securities and Exchange Commission has extended the public comment period on the proposed rulemaking to enhance and standardize climate related disclosures until June 17, 2022.

As a regulation that has been described as a single act that “will change the way business and the economy function,” the ramifications of a short “notice and comment” process, should not be ignored.

Specifically, the SEC extended the comment period for a release proposing amendments to its rules under the Securities Act of 1933 and Securities Exchange Act of 1934 that would require companies to provide certain ESG information in their registration statements and annual reports. The comment period for the release was originally scheduled to close on May 20, 2022. The new comment period will end on June 17, 2022.

The SEC has recently departed from its own precedent on major proposed rules for notice and comment of 60 days after publication in the Federal Register, shortening the comment period to only 30 days after publication in the Federal Register. With the several new final rule proposals issued on February 9 and 10, the SEC limited the public comment period to “whichever is greater” 30 days after publication in the Federal Register or 60 days after posting the notice of proposed rulemaking on the Commission’s website. However, the rule proposals with 30 day comment periods recently issued by the SEC have been published in the Federal Register, on average, 13 days after being posted on the SEC website. Thus, applying the “whichever is greater” standard to those rule proposals would have resulted in only 17 additional days, on average, for public notice and comment on each rule.

After concern was raised by more than a few policy making public officials and at least one SEC Commissioner, the SEC announced this delay intended to allow interested persons additional time to analyze the issues and prepare their comments, on this more than 500 page proposed rule, which we characterized in our earlier blog post, You Should Comment on the SEC’s Transformative Proposed ESG Rule, as being so sweeping as to literally “alter the trajectory of the U.S. economy.”

The SEC has requested comment on a release proposing amendments to its rules under the Securities Act and Exchange Act that would require companies to provide certain climate related information in their registration statements and annual reports. The proposed rules would require information about a company’s climate related risks that are reasonably likely to have a material impact on its business, results of operations, or financial condition.

Significantly, the required information about climate related risks would also include, for the first time, disclosure of a company’s greenhouse gas emissions, which the SEC suggests is a good metric to assess a business’ exposure to such risks (.. which by mandating disclosure of Scope 3 GHG emissions will by implication include not only public companies, but also disclosures by the many other businesses upstream and downstream of a public company’s activities).

In addition, under the proposed rules, certain climate related financial metrics would be required in a company’s audited financial statements.

The comment period for the release was originally scheduled to close on May 20, 2022. The SEC, in its announcement said it now believes that providing the public additional time to consider and comment on the matters addressed in the release would benefit the Commission in its consideration of final rules. Accordingly, the Commission extended the comment period for Release Nos. 33-11042; 34-94478, “The Enhancement and Standardization of Climate-Related Disclosures for Investors,” until June 17, 2022.

The scope and comment process for the proposed rules remains as stated in the original Federal Register notice of April 11, 2022.

We expect an active comment period and that a final rule, very much like that proposed, will be issued in 2022.

The final regulation will change the way business and the economy function. Like the analogy of building the plane while flying it, you should seek to advantage your business by commenting while you also prepare to make GHG emission disclosures. You can learn more about the SEC regulation and comment directly from the link in our blog post above.

ESG has become such a large component of my law practice that I am now collaborating with a fabulous group of attorneys in ESG Legal Solutions, LLC, a new law consulting firm. Nancy Hudes and I are now publishing a new blog at www.ESGLegalSolutions.com (.. yes, this website will continue). This post originally appeared in that blog. If we can assist you or someone you work with in ESG strategy and solutions, from policy to project implementation, do not hesitate to reach out to me.