View by Topic

Recent Articles

-

Congress Blocks California’s Gasoline Car BanSaturday, May 31st, 2025

-

EPA Will Keep Current Limits for “Forever Chemicals” in Drinking WaterSaturday, May 24th, 2025

-

Court Indefinitely Pauses SEC Climate Rule LitigationSaturday, May 17th, 2025

-

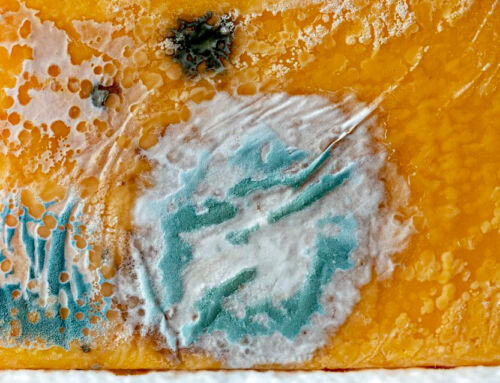

Maryland is About to Regulate Mold But is the Cart Before the HorseSaturday, May 10th, 2025

View by Month/Year

“Green Building Law Update” Headlines

Recent Articles & News from

Stuart Kaplow’s blog

at GreenBuildingLawUpdate.com

- Congress Blocks California’s Gasoline Car Ban: A Legal and Policy Analysis June 1, 2025

- EPA Will Keep Current Limits for “Forever Chemicals” in Drinking Water May 25, 2025

- Court Indefinitely Pauses SEC Climate Rule Litigation May 18, 2025

- Maryland is About to Regulate Mold: But is the Cart Before the Horse? May 11, 2025

Subscribe to the Green Building Law Update!

Stuart Kaplow brings his expertise and extensive experience to the table with his unique digital publication, "Green Building Law Update". Subscribers receive regular updates to keep them informed about important issues surrounding Environmental Law, Green Building & Real Estate Law, as well as the emerging demand for Environmental Social Governance (ESG).

Get fresh content through the lense of Stuart Kaplow's cutting-edge expertise, innovative commentary and insider perspective. Don't miss another issue! Subscribe below.

Ukraine is Now a Real ESG Issue

While there has been near universal condemnation of the war against Ukraine by Russia, and our empathy is unequivocally with the people of Ukraine, this invasion of a sovereign nation, something that echoes the darkest days in European history, today presents an issue of ESG.

This blog post is being written 9 days after Putin’s war began (although the Russian Duma just criminalized calling it anything other than a “special military operation”).

Russia’s invasion of Ukraine has already triggered a humanitarian crisis far wider than only the fleeing refugees and international sanctions are beginning to ripple across the world’s economies impacting businesses large and small.

When matters of ESG are considered, in the vast majority of instances, what is being discussed is the ESG rating of a company, but there are also ESG rating of countries, from the highest AAA all the way down to CCC. The government ratings generally track how a nation state’s exposure to and management of ESG risk factors might affect the sustainability and competitiveness of its economy. While there is some variation among advisors, the methodology often applies a 50%, 25% and 25% weight for governance, social and environmental factors, respectively.

Two days ago, several key investment advisors downgraded Russia and Belarus in response to Russia’s invasion of Ukraine. MSCI, among the largest players in this space, said it cut Russia to “B” from “BBB” and Belarus to “B” from “BB” adding that both had a negative outlook.

It may appear unseemly to capitalize on the misery of the people of Ukraine to discuss matters of ESG, even with a blog post like this, but as ESG has exploded on the scene over the past 12 months it is evolving to a point where in encompasses nearly everything? But we are comfortable with this post because at the core of ESG is the oldest moral guidepost that exits, the Golden Rule, “Do unto others as you would have them do unto you,” and there is no doubt that has been violated in Ukraine.

We are seeing a business response to this conflict with more good, like possibly never seen before including articulating the social and governance violations, including the governance factors of decision making by a sovereigns’ policymaking that this act of aggression represents. The business community appears to understand that protecting freedom and democracy (.. Putin reportedly “despises” democracy) is part of their ESG responsibility. We wrote in a blog just some days ago about a company’s relationship with supporting democratic values, The ESG Benefit of Paying Employees to Work at the Polls. In this instance companies appear to be aware of the critical role they must play if advocating for key ESG values like rule of law, good governance and human rights.

It is one thing for companies to comply with U.S. government imposed sanctions, but companies are now making voluntary elections to retreat from doing business with Russia.

The cynical will see businesses seeking to protect their reputations. Optimists will see this as aligning company values and taking an activist stance, even at some cost. We suggest companies are and will be judged on how they respond to this moment and that is real. The Ukraine invasion could be the 21st century equivalent of the late 20th century anti-apartheid movement, in which business banded together through boycotts to counter the racism of the white nationalist South African regime, but this time accelerated, with responses coming in hours not years, and amplified by social media, making it harder for us all to look away.

This is not the Cesar Chavez boycott of table grapes in 1965 that divided American businesses and people across our country. In the last 9 days, the response has been all but universal from a local liquor store removing Russian vodka from the shelves to a symphony orchestra cancelling performances by a renowned Russian violinist to major oil companies, that are an industry expressly exempt from sanctions, self sanctioning by not bidding on Russian oil at auction this week to overnight package delivery services suspending deliveries in Russia. With no good end to this war in sight, there are already issues of the efficacy in cancelling all things the Russian people versus the Communist leader Putin.

And there are other complicated issues here, including that many companies in the defense industry had been shunned by ESG investors, but as the Latvian deputy prime minister said this week “is national defense not ethical” so how are weapons manufacturers going to be viewed as their armaments defend Ukraine? Also complicated are the Export Administration Regulations that essentially prohibit U.S. companies from complying with aspects of other country’s boycotts that our government does not sanction and while in this instance action by the government seems unlikely, the regulation exists.

In 2022 companies supporting democratic values will not only be awarded with high ESG scores, but also championed by the overwhelming number of people shocked and dismayed by the Russian invasion of a smaller sovereign state, who want to see more good and humanity do better at repairing the world.

To misappropriate the powerful words from 1963, “Ich bin ein Ukrainian.“

ESG has become such a large component of my law practice that I am now collaborating with a group of daring, innovative and creative attorneys in ESG Legal Solutions, LLC, a boutique ESG driven non-law and consulting firm “powering sustainability, today, for tomorrow’s business.” Nancy Hudes and I are now publishing a blog www.ESGLegalSolutions.com (.. yes, this website will continue). This article originally appeared in that blog. If we can assist you or someone you work with in ESG strategy and solutions, from specific project implementation to fractional fully managed services, do not hesitate to reach out to me.